How to identify areas poised for growth

- Look for areas experiencing gentrification

These areas may have had a poor reputation in the past, but are now seeing homeowners moving in and changing the landscape of the suburb.

– Look at the affordable areas in a region you’re interested in;

– Check out how the property prices have moved in the past two to three years;

– If prices have grown steadily, look at the demographics. An increasing number of young residents with decent income is a solid indication that the suburb is headed for gentrification;

– Look for new houses or renovated homes springing up in the area;

– Look for new cafes or retailers opening in the suburb.

- Look for the ripple effect

If you can’t afford to buy into a high growth area (you might have just missed the mark this time around), you might still be able to buy into the area by checking the surrounding suburbs. This requires timing, so you need to know which phase of the cycle the local property market is in to maximise your chances of riding the wave of growth.

Top tips for finding areas before the ripple of growth hits:

– Measure property values by comparing the median prices of adjoining suburbs;

– If there is more than a 5% variation, chances are the suburb next door will be playing catch-up;

– Closely monitor median price trends on a quarterly basis. Once you are certain the cycle has kicked off, look for properties within your budget that are as close to the growth as possible. Subscribe to alerts from realestate.com.au for properties coming on to the market;

– A good rule of thumb when buying in the capital-city suburban markets is to buy within 20km of the CBD, growth is virtually assured to ripple this far out during a cycle.

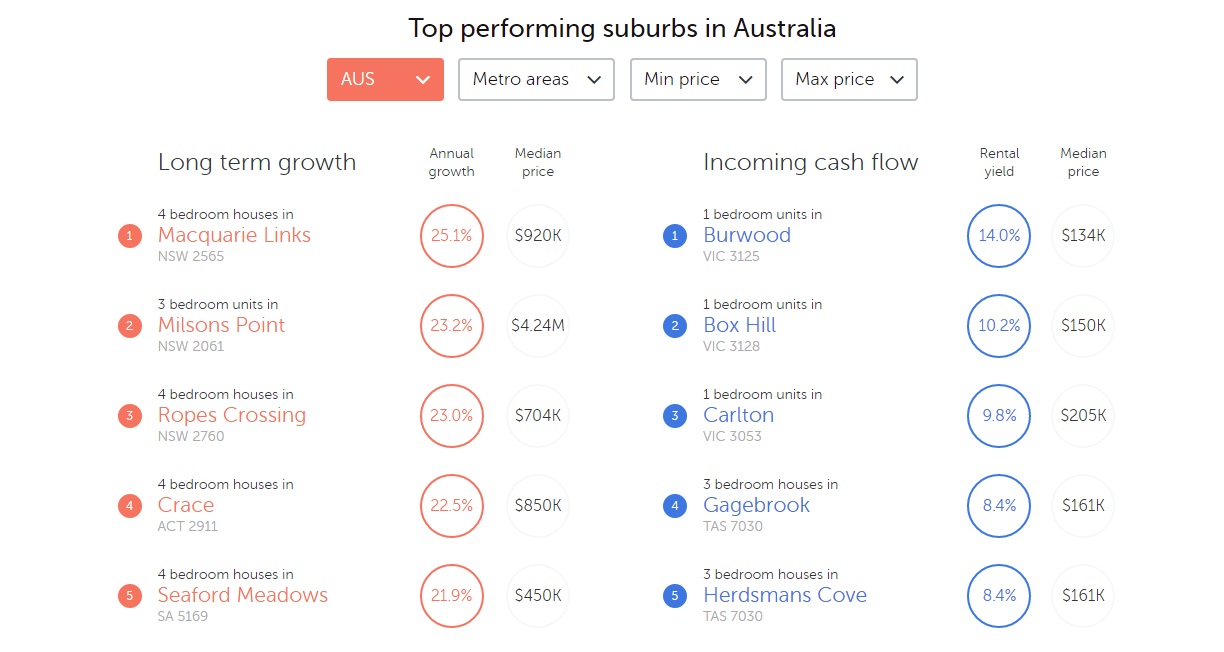

Supply and demand, demographics, prices over time etc. can be found on realestate.com.au in the dedicated Investor section where you will find annual growth, median price and rental info. Usually it’s too late for these suburbs, they will have peaked already, so use this information to seek out surrounding suburbs that haven’t experienced growth yet. You can also use this to support you in the next step.

- Examine supply and demand

The ratio of supply versus demand of properties in an area is a key driver of price growth. If there is no more capacity to build in the suburb, but demand keeps on growing, prices will likely climb.

Top tips for finding high-demand, low-supply areas:

– Look for areas where the rental yield is rising. This indicates that an area is popular among renters. When renters become homeowners they also tend to buy in the same area they’re renting in;

– Look at the demographics of people moving into the area. Suburbs where the median age is around 35 or so tend to gentrify faster as these demographics tend to have better income and are therefore able to afford to buy or rent more expensive properties;

– Look for areas with rising population. A growing population combined with other indicators such as rising income and low supply, is a good indication that property prices will grow in the area.

- Look for large infrastructure projects underway

This is a good indicator that the area is likely to see a spike in housing demand as workers flock in for jobs. Projects that are already commenced are preferable, as project promises can fall through as governments rotate and budget priorities shift.

Contact Us: Sales 0402 468 248 - Property Management 0411 113 881